‘Bottomless pits of capital’: Hotel investors think long term

As seen in the Financial review

Larry Schlesinger | July 29, 2021

Offshore capital is pouring into Australia’s hotel sector despite average occupancy rates tumbling to 40 per cent around the country because of the latest Sydney lockdown, state border closures and uncertainty about when domestic travel will resume.

Analysts and hotel brokers said investors were taking a long-term view and taking confidence from the historical performance of markets such as Sydney, which had average occupancy rates above 85 per cent prior to COVID-19, and which they expect to eventually bounce back.

“There’s still bottomless pits of capital for hotel investment,” Dean Dransfield ofhotel advisory firm Dransfield said.

“We’re involved in six deals as we speak worth well over $1 billion. Capital markets are not worried at all.”

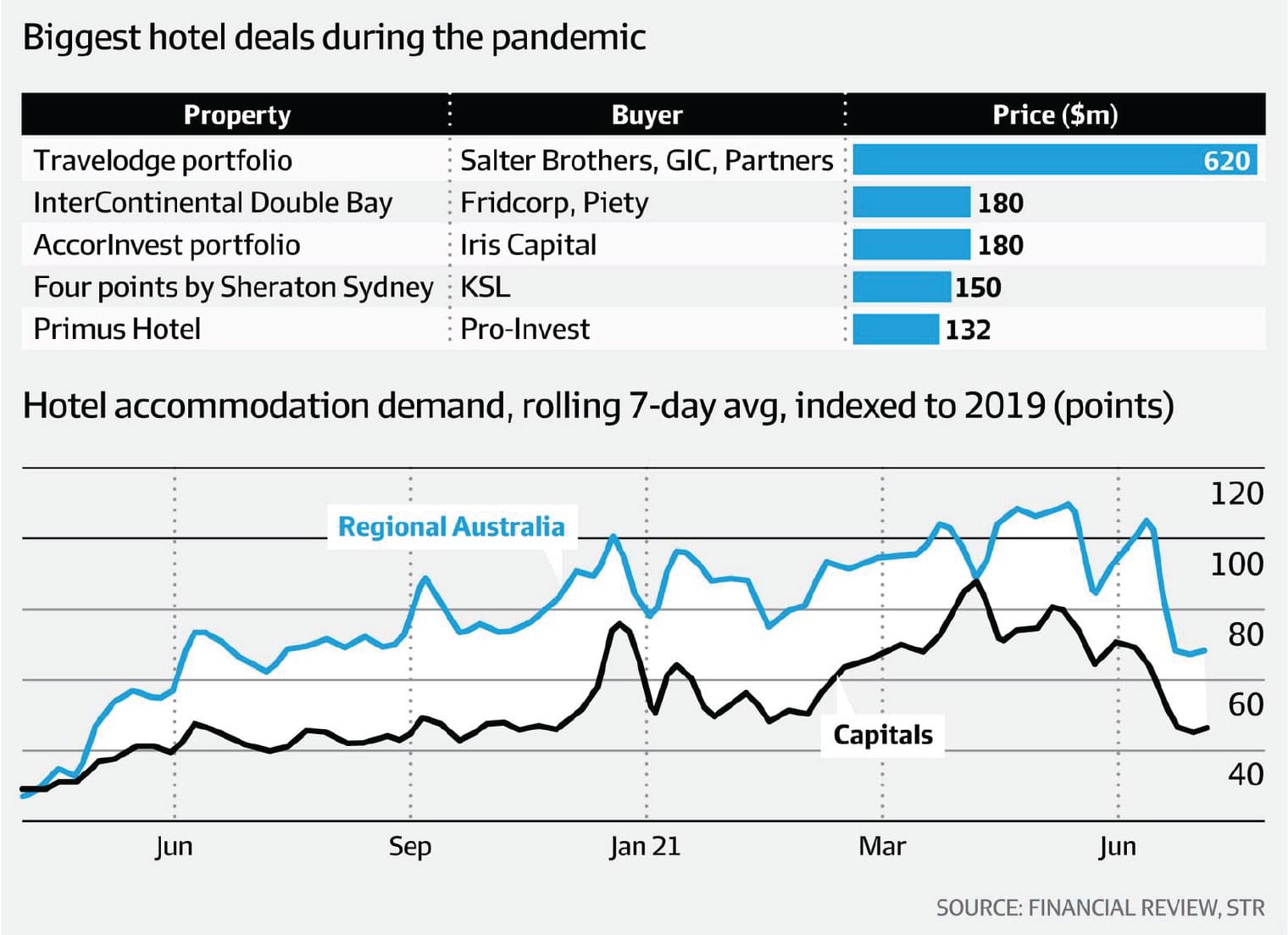

Major hotel deals worth $1.2 billion have been struck for the year to date, more than double the same time last year. This figure received a huge boost from the record $620 million acquisition of the Travelodge portfolio by fund manager Salter Brothers, in a joint venture with Singaporean sovereign wealth fund GIC and Swiss-based investment manager Partners Group.

Other major deals include the sale of Jerry Schwartz’s Four Points by Sheraton Jerry Schwartz’s Four Points by Sheraton Sydney hotel for about $150 million to Colorado-based tourism group KSL and the Primus Hotel in the Sydney CBD bought by fund manager, developer and operator Sydney CBD bought by fund manager, developer and operator Pro-invest for $132 million.

CBRE Hotels managing director Michael Simpson said heightened uncertainty last year had pushed down hotel sales, but greater visibility around the timing for the recovery, including the approval of multiple alternative vaccines around the world, meant buyers were now able to price risk and future returns, and thus acquire assets

Offshore groups are focusing on the longterm fundamentals of the Australian hotel market”

— Gus Moors, Colliers International’s head of hotels

“We believe that this will be an emerging theme as the 2021 calendar year progresses, and into 2022,” Mr Simpson said.

“Despite the short-term very adverse impacts of the current lockdowns in Sydney and Melbourne, which have seen occupancies plummet for hotels, there is a deep pool of buyers from all around the world seeking investment-grade hotel assets in Australia.

“These include the traditional buyers from south-east Asia but also global private equity investors, pension funds, sovereign wealth funds and global ultra-high net worth investors. This increased competition from buyers is causing a tightening of yields when measured against stabilised income levels.”

JLL Hotels managing director Peter Harper agreed, but said a two-tier market was playing out.

“Offerings that are considered trophy, unique or provide scale have attracted strong buyer interest … however those considered ‘secondary’ are undergoing an adjustment to risk expectations and, in turn, a more opportunistic view on pricing, ”Mr Harper said.

“This is where we’ve seen deals fail to materialise as hotel owners are so far not under any great level of stress [to sell] owing to relatively low gearing, strong lender relationships and the benefi ts of various government stimulus.”

Importantly, the sales have not reflected any major devaluation trends, despite earlier concerns that the pandemic would send values plummeting. The Travelodge portfolio sold more than $100 million above its 2020 book value and almost $40 million higher than its pre-COVID-19 valuation of $583 million, despite seven of the 11 hotels being in Sydney and currently closed.

Highlighting the level of appetite among investors, the Travelodge portfolio attracting 18 bids, selling agent Sam McVay of McVay Real Estate said.

Colliers International’s head of hotels, Gus Moors, said Pro-invest’s Primus Hotel deal was “fully priced” at $767,000 a key, while Dr Schwartz would “make his money back” on the Four Points sale despite being public about coming under pressure from his lenders to offload assets.

“Offshore groups are focusing on the long-term fundamentals of the Australian hotel market, and that in Sydney in particular assets are typically tightly held,” Mr Moors told The Australian Financial Review.

“They understand the longer-term fundamentals are very strong and that there is an opportunity to get into the market and get set. The recognise there will be a tough year or two [of operating conditions] before a bounce back.”

In the short term though, hotel owners and operators, especially in Sydney wherethe lockdown has been extended to the end of August, are facing huge challenges.

According to hotel research house STR, the latest lockdowns have sent national occupancy rates plunging from 62.6 per cent at the start of May to 40 per cent by mid-June, led by the capital cities.

Bookings are also being cancelled at a higher rate, and further into the future, amid consumer expectations that the situation is unlikely to improve any time soon.

“Sydney’s occupancy has now dipped below 20 per cent, which primarily is tied to quarantining travellers, and at levels last seen in May of last year,” Matthew Burke, regional manager for the Pacific at STR, said.

In Canberra, where occupancy in May and June averaged a healthy 66 per cent, that has fallen 25 per cent, refl ecting the impact of Sydney’s closure on its neighbouring market.

Mr Dransfield, though, predicted Sydney occupancy rates would return to the early to mid-80 per cent level “several years after COVID”.

“The pipeline of new hotels has never been big enough to stop that. COVID won’t stop it. Investors are buying with a minimum five-year holding window and looking for capital value uplift,” he said.