Salter Brothers hit the market with new tech fund

As seen in the Australian Financial Review

Melbourne-based fund manager Salter Brothers is eager to get in on the tech wreck.

Street Talk understands Gregg Taylor’s new wholesale equities fund will launch this week, targeting $50 million in commitments to funnel into private and listed multi-stage tech companies.

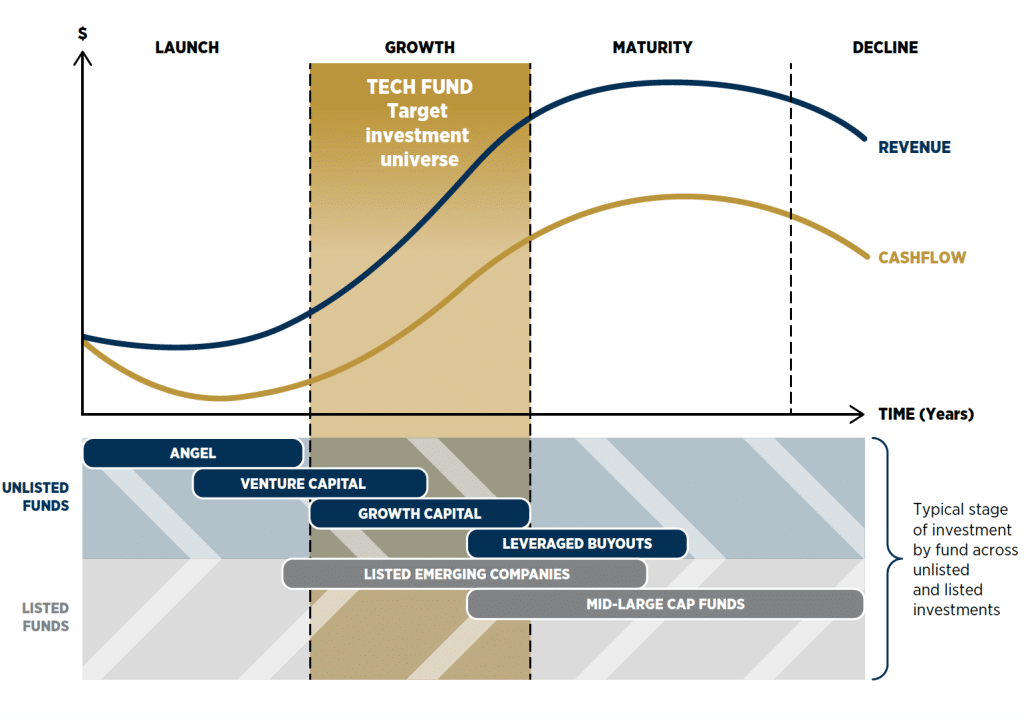

The unlisted fund will focus on five verticals, telecommunications, enterprise software, fintech, medtech and property tech, seeking to take advantage of what they see as a 20-year valuation lull in the sector.

“We believe that the current vintage of our Fund presents a compelling opportunity for investors to enter the market at attractive valuations in the technology sector, where valuations are extremely depressed,” potential investors were told.

The investment committee – made up of Taylor, Salter Brothers chief Robert Salter and Waves Tech Ventures co-founder Hayley Evans – will be advised by a group of industry specialists including eftpos Australia chief executive Stephen Benton and Nu Mobile’s boss Paul O’Neile. Investment director Tineyi Matanda and former Morgans stockbroker Chris Titley feature on the fund’s investment team.

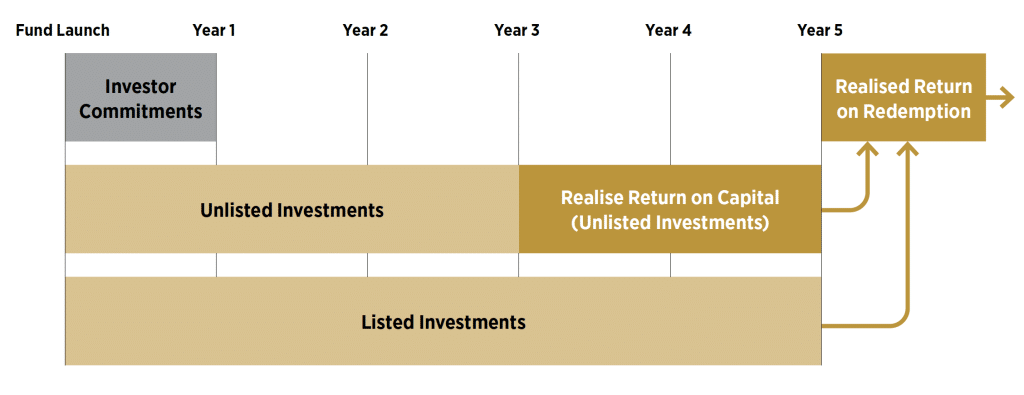

The Salter Brothers Tech Fund has a 5-year lock-up period and is targeting a 15 per cent gross internal rate of return. It will charge a 2 per cent management fee and a 20 per cent performance on outperformance of a 5 per cent hurdle over the financial year, subject to a high watermark.

The fund will be nestled alongside the Salter Brother’s private equity and listed equities funds, under the firm’s funds management umbrella, which also includes a property and credit arm. Salter also operates an advisory and capital markets business and a Significant Investor Visa program and has around $3 billion in assets under management.

Investor commitments will be accepted in the first year after the launch and unlisted investments made in the first three years. Most of its investments will be centred on Australian and New Zealand small and mid-sized venture capital and late-stage/pre-IPO tech with around a third in listed equities and cash.

The investment house’s equity investments over the years include foreign exchange trading platform OzForex, digital payments business IP Solutions International, fintech Verrency and liquor producer and marketer Top Shelf International Holdings.